Bank reconciliations...I know eeeww!

Balancing the books does not have to be a complicated art that only your accountant has the skills to do.

However, reconciling the bank accounts, loans, and credit cards is essential in the accounting cycle.

Try this helpful tip to make your reconciliations a breeze.

In a previous post, I discussed how sorting your accounts by cleared status can help manage cash flow. This feature also allows for daily, weekly, or monthly reconciliations.

Here is how you perform daily reconciliations in QuickBooks Online (QBO):

- Click on any bank account or credit card account to open that account's register

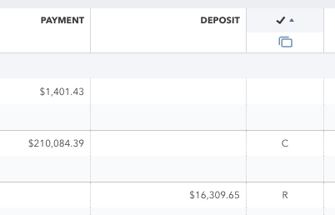

- Following the payment and deposit columns, you will notice a checkmark-marked column on the right side of the register.

- This column shows uncleared, cleared, and reconciled transactions.

- You can visually reconcile your account balance by pulling up the ending balance of each transaction or day's activity.

- This column shows uncleared, cleared, and reconciled transactions.

There are two HUGE advantages to doing this:

- Your monthly reconciliation to your bank statement will be done, quickly.

- Combining this procedure with sorting by cleared status allows you to gain even more control over your cash flow.

.webp?length=425&upscale=true&name=blog_banner-_1__1%20%281%29.webp)